Client #2

Current Situation

Monthly Income: $1,500 (after tax)

Fixed Expenses: $640/month

Lifestyle Buffer: $60/month

Reflects realistic spending on clothing, social events, and entertainment

Serves as a cushion, not a spending target, to keep your plan accurate and aligned with actual habits

Total Estimated Monthly Spending: $700

Monthly Surplus: ~$800

Summary:

The $800 remaining each month currently has no structure or direction.

Once allocated, this surplus becomes the foundation of your financial roadmap—supporting your emergency fund, savings goals, and long-term growth.

The Flow

At present, income is received, held in a chequing account, and gradually spent without a defined structure. This passive cycle results in untracked outflows and the gradual disappearance of your $800 surplus each month.

Understanding Flow

Financial clarity begins when every dollar has a defined purpose—whether allocated toward stability, growth, or discretionary use.

Current Flow:

Income ($1,500) → Expenses ($1,500)

This structure shows an income pattern that begins and ends in spending, with no capital retention.

Lucent Flow

Introducing the Lucent Flow, designed to create separation between saving and spending. This framework prioritizes savings first, providing structure and intentional control over cash flow.

Lucent Flow:

Income ($1,500) → Savings ($800) → Expenses ($700)

Ideally, living expenses should remain below 50% of income. At 47%, your current ratio aligns well with this target. The next step is assigning the remaining 53% ($800) to structured savings.

When savings are automated immediately after payday, spending becomes intentional and free of guilt. This process transforms financial behavior from reactive to proactive.

Payday Routine

A defined payday routine converts income into progress through automated, predictable allocation. Assigning purpose upon receipt of funds eliminates uncertainty and prevents unplanned spending.

Biweekly Income: $750 (after tax)

Allocation:

Savings – $400: Transfer immediately to savings. This represents your “pay yourself first” contribution, used to build your emergency fund and other goals.

Expenses – $350: Retain in chequing for personal and variable costs such as food, transportation, and daily spending.

Spending Breakdown:

$350 biweekly

→ $175 weekly

→ ≈ $25 daily

This breakdown provides structure while maintaining flexibility. Following this routine consistently keeps spending predictable and sustainable. Over a month, this system results in $700 spent and $800 saved, forming a balanced 50/50 flow that reinforces control and habit development.

Emergency Fund

An emergency fund forms the foundation of financial security. It is a liquid reserve held in a separate account to cover unplanned expenses such as car repairs, medical costs, or temporary income loss.

Objective: Preserve lifestyle stability during financial disruptions.

Target: $5,000 within 7 months.

Monthly Contribution: $800.

This amount provides adequate protection, particularly given your goal to purchase a vehicle in the near future. The fund should remain fully accessible in a high-interest savings account to protect purchasing power and maintain liquidity.

Step-By-Step Plan

Step 1: Know the goal

The goal is simple, build an emergency fund of $5,000 over the next 7 months. That breaks down to saving $800 per month.

Step 2: Build the habit

Consistency is what matters. By saving $800 per month you’ll reach your target without feeling pressure, treat this as paying your self first.

Goal 3: Buying Your First Car

You’ve expressed interest in purchasing your first vehicle. The following outlines both available approaches—cash purchase and financing—and provides a recommendation based on your current income and expense profile.

Option 1: Purchase with Cash

Vehicle Cost: $5,000–$6,000

Additional Fees: ~$1,000 (licensing, safety inspection, MTO fees, appraisal)

Vehicle Example: Mitsubishi Lancer

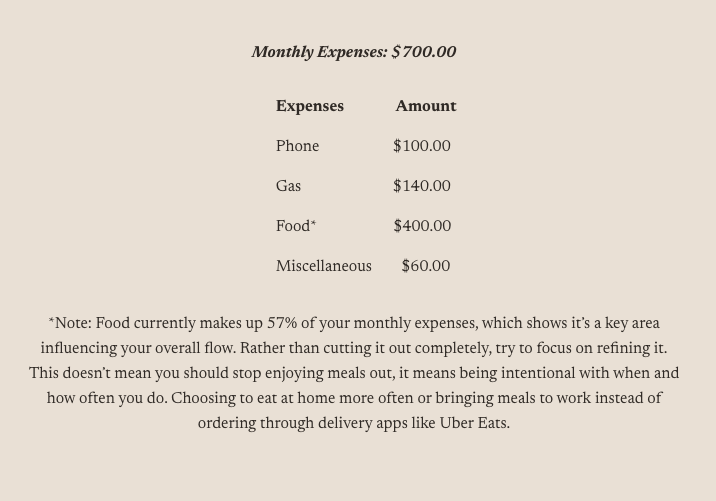

Expense Amount

Phone Bill $100

Gas $140

Food $400

Miscellaneous* $110

Insurance* $300

Miscellaneous: Increased by $50/month to account for minor maintenance, repairs, or fluctuating gas prices. If unused, this money can be redirected to savings.

Insurance: The estimated value and actual cost depend on location, driving history, age, and insurance provider.

Summary:

This option is straightforward and manageable. You avoid monthly payments, giving you flexibility and room to save or invest elsewhere while fulfilling your goal

Estimated Total Monthly Expenses: $1,050

Option 2: Financing a Car

Purchase Price: $20,000

Down Payment: $5,000–$6,000

Financed Amount: $14,000–$15,000

Expense Amount

Phone Bill $100

Gas $140

Food $400

Miscellaneous* $110

Insurance* $450

Car Payment $400

*Insurance: Estimated at $450/month to reflect higher costs for full coverage.

*Miscellaneous: Still includes allowance for maintenance and repairs.

Summary:

This option is more complicated. To be straightforward, your income isn't high enough to finance a vehicle at this stage in your life. You simply can't afford to finance a vehicle. Estimated Total Monthly Expenses: $1,600

(You would be approximately $100 over budget each month).

Lucent Recommendation

Option 1 (cash purchase) is the recommended approach. It maintains stability, prevents overextension, and allows continued savings growth. Financing a vehicle under current conditions would strain cash flow and eliminate flexibility. Once income increases, financing can be revisited with a stronger foundation.

Gameplan

Now that your emergency fund is fully built, your next milestone is saving $7,000 for your first car. Beginning in May 2026, you’ll set aside $600 that month, followed by $800 each month until you reach your goal.

Start: May 2026 ($600 saved)

Continue: June–January 2027 ($800/month)

Goal reached: End of January 2027

By early 2027, you will be positioned to purchase your vehicle outright while maintaining your $5,000 emergency reserve. With total expenses estimated at $1,050, you’ll retain an additional $450 per month to begin your investment phase.

Step Sequence:

Save $800/month for 7 months to build a $5,000 emergency fund (Nov 2025–May 2026).

Save $800/month for 8 months to build $7,000 for vehicle purchase (May 2026–Dec 2026).

Begin investing $450/month through a registered account (TFSA/FHSA/RRSP) starting Jan 2027.

Learning Tools

Under this section, we’ve provided tools to help you better understand the concepts mentioned throughout your roadmap. Instead of going in-depth with textbooks or reading materials, we’ve catered to your visual learning style by linking videos we personally recommend. These will simplify key ideas, reinforce what you’ve learned, and keep you engaged as you continue building your financial knowledge.

Linked Videos

Recap

Your financial roadmap establishes a clear foundation built on structure, discipline, and transparency. With a consistent monthly income of $1,500 and total expenses of approximately $700, you maintain a surplus of $800 that, once organized, becomes the cornerstone of your progress.

A new Lucent Flow has been introduced to replace passive spending with intentional allocation:

Income → Savings → Expenses.

This approach prioritizes paying yourself first, ensuring your money moves with purpose rather than disappearing through untracked spending.

Your payday routine now automates savings and expenses on a biweekly cycle, simplifying decisions and creating balance between financial growth and day-to-day flexibility. Consistently following this structure will establish strong saving habits and guard against lifestyle inflation as your income increases.

The roadmap’s first milestone is building a $5,000 emergency fund within seven months. This reserve serves as a financial safety net, protecting your lifestyle and preventing reliance on credit when unexpected events occur. Once completed, attention shifts to your next objective — saving $7,000 for your first vehicle, targeted for completion by January 2027.

The analysis of vehicle options highlights that purchasing with cash remains the most practical choice at this stage. It maintains stability, avoids unnecessary debt, and allows for continued savings growth. Financing will be revisited once income expands and liquidity is stronger.

Following the car purchase, your expenses will total roughly $1,050 per month, leaving an estimated $450 monthly available for investment contributions. At that point, the focus transitions to building long-term wealth through registered accounts such as a TFSA, FHSA, or RRSP.

In summary, this roadmap transforms unstructured cash flow into a controlled, forward-moving system. It secures your financial base, establishes disciplined habits, and positions you for a smooth transition into investing once core stability is achieved.