Diversification

Here is everything I’ve learned about diversification. We often hear the phrase “never put all your eggs in one basket,” but I prefer to think of diversification as deciding how many eggs belong in each basket.

Diversification is one of the most fundamental principles in investing, yet it is often misunderstood. At its core, it is not about owning many investments; it is about owning the right combination of investments to manage risk while pursuing return.

Diversification ties together several key concepts: risk and return, correlation, risk measurement, asset allocation, and rebalancing. When understood together, these ideas form the foundation of sound portfolio construction.

Risk and Return

All investments involve risk, and that risk exists because investors expect to be compensated with return. Generally, higher expected returns require accepting higher levels of risk. The goal of portfolio construction is not to eliminate risk, but to manage it. Diversification helps reduce unnecessary risk while maintaining the portfolio’s return potential.

Types of Risk

Understanding diversification begins with understanding the types of risk it addresses:

Systematic risk

Market-wide risk that affects all investments (interest rates, inflation, recessions). This risk cannot be diversified away.Unsystematic risk

Company- or sector-specific risk (management issues, industry downturns). This risk can be reduced through diversification.

Diversification is primarily concerned with reducing unsystematic risk, allowing investors to be compensated only for the risks that matter.

Measuring Risk Through Variance and Standard Deviation

Variance measures how widely returns deviate from the average return.

Standard deviation is the square root of variance and is the most commonly used risk measure.

A higher standard deviation indicates greater volatility and therefore higher risk. When combining investments into a portfolio, diversification can lower the portfolio’s overall standard deviation, even if individual investments remain volatile.

Correlation

Correlation measures how two investments move relative to one another, ranging from +1 to –1:

Perfect positive correlation (+1): investments move together

Perfect negative correlation (–1): investments move in opposite directions

Low or zero correlation: movements are unrelated

Diversification works best when assets have low or negative correlation. Combining assets that do not move together smooths portfolio returns and reduces overall risk without proportionally reducing expected return.

Beta

While standard deviation measures total risk, beta measures systematic risk, how sensitive an investment is to overall market movements.

Beta of 1.0: moves in line with the market

Beta greater than 1.0: more volatile than the market

Beta less than 1.0: less volatile than the market

By combining assets with different betas, investors can tailor a portfolio’s sensitivity to market movements while still remaining diversified.

Asset Allocation

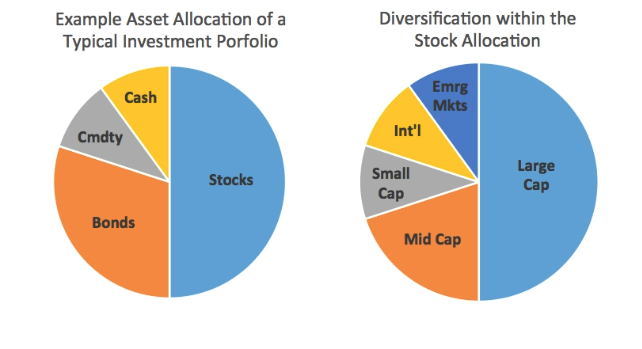

Asset allocation refers to how a portfolio is divided among major asset classes such as:

Equities (growth)

Fixed income (income and stability)

Cash equivalents (liquidity)

Asset allocation is the most important determinant of portfolio risk and return, more impactful than individual security selection. Diversification occurs first at the asset-class level and then within each asset class.

Rebalancing

Diversification is not a one-time decision. As markets move, asset weights drift away from their target allocation.

Rebalancing involves periodically adjusting the portfolio back to its original asset mix. This process:

Maintains the intended risk level

Reinforces discipline

Encourages buying low and selling high

Without rebalancing, even a well-diversified portfolio can gradually become misaligned with an investor’s objectives.

Diversification Beyond Just Correlation

Diversification is addressed across three major dimensions:

Geographic diversification

Asset class diversification

Investment-style and structure diversification

Geographic Diversification (Foreign Markets)

Why Foreign Diversification Matters

Different countries experience different economic cycles

Reduces reliance on a single economy, currency, or political system

Foreign markets may offer higher growth potential

Key Concepts

Developed markets: U.S., Europe, Japan

More stable, lower political risk

Emerging markets: China, India, Brazil

Higher growth potential, higher volatility

Currency Risk

Foreign investments introduce currency risk

Exchange rate movements can:

Increase returns

Reduce returns

Currency risk adds diversification but also volatility

Currency exposure can be seen as both a risk and a diversification tool

2. Asset Class Diversification

a) Money Market Investments

Purpose: Liquidity and capital preservation

Low risk

Low return

Very low volatility

b) Fixed Income (Bonds)

Purpose: Income and stability

Key diversification benefits:

Lower volatility than equities

Often low or negative correlation with stocks

Predictable income stream

c) Equities (Stocks)

Purpose: Growth

Characteristics:

Highest long-term return potential

Highest volatility

Exposed to market and company-specific risk

Diversification within equities includes:

Sector diversification

Market-cap diversification

Geographic diversification

e) Precious Metals (Gold, etc.)

Purpose: Store of value and hedge

Key features:

Often performs well during:

Inflation

Market stress

Currency weakness

Low or negative correlation with equities

Bringing It All Together

If I were to conclude diversification into one paragraph, I would explain that diversification is not about eliminating risk; it is about controlling risk efficiently based on risk tolerance and time frame. Being able to understand the concepts mentioned, investors can build portfolios that are resilient, intentional, and aligned with their specific goals.

In practice, diversification is the bridge between theory and discipline, transforming individual investments into a coherent, risk-managed portfolio.